The impact of rapid fuel costs inflation on Arkansas’ logging sector

The impact of rapid fuel costs inflation on Arkansas’ logging sector

Ana Gutierrez-Castillo,a Nana Tian, b and Matthew Pelkki,a,*

a: Arkansas Center for Forest Business, College of Forestry, Agriculture and Natural Resources, University of Arkansas, Monticello, AR, USA

b: Arkansas Forest Resources Center, College of Forestry, Agriculture and Natural Resources, University of Arkansas, Monticello, AR, USA

*Corresponding author: E-mail: pelkki@uamont.edu

Citation: Gutierrez-Castillo A., Tian N., Pelkki M. 2022. The impact of rapid fuel costs inflation on Arkansas’ logging sector. J.For.Bus.Res. 1(1): 75-89.

Received: 2 September 2022 / Accepted: 19 December 2022 / Published: 23 December 2022

Copyright: © 2022 by the authors

ABSTRACT

The logging sector is vital to the wood supply chain supporting both the sustainable management of forest resources and the prosperity of the forestry industry. This study analyzed the immediate impact of rapid fuel cost inflation from February to May of 2022 on the logging sector based on a survey sent to 430 logging and/or hauling firms in Arkansas. We made a direct comparison between the January and May operating costs and production quantities. Results showed that on average logging and/or hauling firms paid about 50% more per liter of diesel fuel in May as compared to January; however, their purchasing frequency remained unchanged, and purchasing quantity for off-road and on-road diesel increased slightly. More than half of the firms received additional compensation from sawmills, averaging $1.4 per metric ton. The overall timber production declined in May with respect to January, but the firms displayed different reactions. Whereas 31.6% of the firms harvested more and 18.4% kept their production constant, 50.0% of the firms significantly lowered their production by 16.1%. There are several potentially confounding factors explaining the loggers’ different responses during the high fuel price context.

Keywords: logging, timber hauling, fuel cost, inflation, Arkansas

INTRODUCTION

The logging sector is a vital component of the wood supply chain in Arkansas, where hundreds of independent loggers harvest timber on both public and private lands to deliver it to the forest products mills in Arkansas and adjacent states. Logging businesses also cut trees into sawlogs, which produce lumber, and as a byproduct, wood chips are transported to sawmills and wood pulp mills, respectively. Those logging businesses provide a way to capture the gains in forest productivity and monetize the forestland investment and biological growth (Mei et al. 2013).

Logging businesses, business owners, and their log-harvesting equipment and vehicles have experienced dramatic changes. For example, during the 1960s-1980s, harvesting operations experienced a rapid mechanized process, which transformed the logging industry from a labor-intensive industry to a capital-intensive industry (Loving 1991, LeBel 1993). Currently, the most common and productive harvesting operations in the Southeastern U.S. are fully mechanized and based on whole tree harvesting systems. In contrast, the common operations in mountainous terrains, such as those found in the Lake States and Northeast US, are chainsaw, cable yarding, and cut-to-length systems.

Despite the differences in the various harvesting systems, harvesting costs are an important component in the harvest system analysis. Estimation of harvesting costs is typically a combination of the costs generated by the machinery and personnel involved. In addition, productivity also affects the harvesting costs, given it differs with site conditions. Another essential component of the harvesting costs in the logging business is fuel consumption in timber harvesting and transportation. Therefore, the variability in the fuel price will also impact the logging business in terms of harvesting costs and productivity. Baker (2014) reported that fuel makes up 22.8% of the in-woods logging costs, only behind labor costs. Consequently, it becomes increasingly important to quantify and measure energy inputs and costs within the logging business.

Research has been carried out to identify the factors that influence the costs involved in the logging operation. For example, Miyata et al. (1981) reported that factors like harvesting equipment, timber size, scattered logging sites, inflation, production, and labor costs contributed to the costs of logging operations. Regarding the costs involved in timber harvesting and transport, fuel costs are the most significant component. As reported by Greene et al. (2014), fuel costs were impacted by haul distances, logging conditions, and market fuel prices. Cut-and-haul rates (the amount loggers and haulers are paid for their work) were evaluated using a costing index, and Baker et al. (2014) found a strong correlation between the cut-and-haul rate and the large inflation observed in diesel fuel prices in 2008. In terms of fuel consumption for specific logging equipment, it depends on factors such as engine size, load factor, equipment condition, operator, logging site conditions, and the basic design of that equipment (Miyata 1980).

A commonly used method for generating harvesting costs data is through surveying the harvesting contractors, which can provide the potential to compare the costs trend over time by repeating periodically (Cubbage and Carter 1994, Baker and Greene 2008). However, Stuart and Grace (1999) and Leon and Benjamin (2013) reported that it could be more time-consuming if surveyed contractors were required to provide detailed costs-related data. Various industry groups and universities conduct surveys of logging businesses; for example, the University of Georgia has conducted the Georgia logging business survey every five years since 1987 (Greene et al. 1988, Greene et al. 2001, Baker and Greene 2008, Greene et al. 2013). The survey data generally includes information on equipment, productivity, financial investment, and other logging business characteristics. Other surveys conducted by Moldenhauer and Bolding (2009) and Conrad (2014) addressed the issue of parcelization; Smidt and Blinn (1994), Egan et al. (1997), and Egan (2005) investigated issues of training needs for loggers; Montgomery et al. (2005) and Kelly et al. (2017) collected information on the implementation costs of best management practice. TimberMart-South, a private, non-profit entity associated with the University of Georgia, maintains quarterly logging cost price indices for the US South.

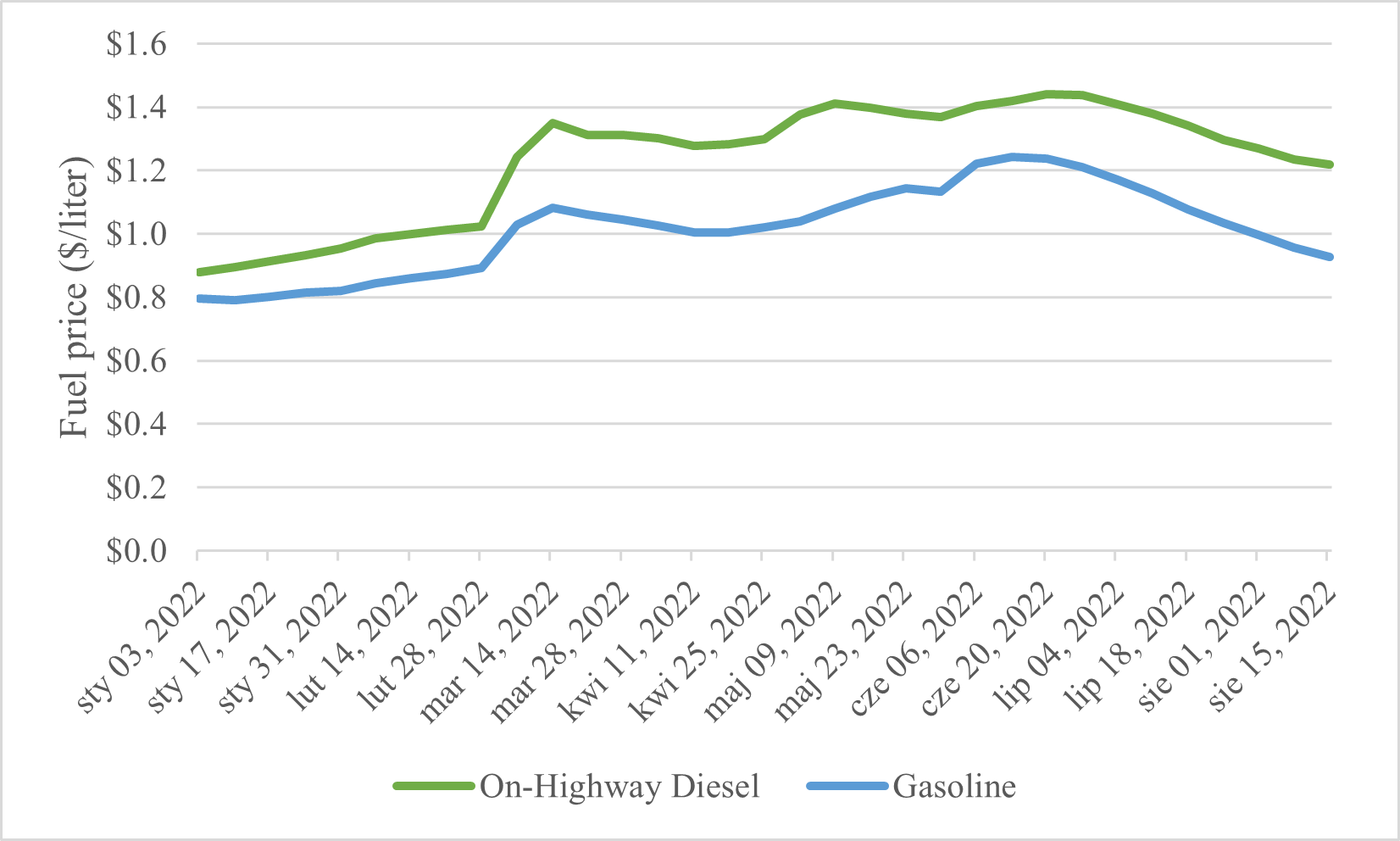

This study explored how logging and/or hauling firms responded to the most recent fuel price increase. Crude oil supply and demand fundamentals pushed fuel prices up in the U.S. from February to June 2022. Typically, diesel fuel accounts for 80% of fuel costs of logging operations in the U.S. South, with gasoline representing the remaining 20%. According to the U.S. Energy Information Administration (2022), the average diesel price in January 2022 along the Gulf Coast was $0.915 per liter. By June, it had increased to $1.425 per liter, a 56% increase and 112% higher than the five-year average price in 2015-2020. The cut and haul costs follow the fluctuations in diesel prices (Baker 2022). In the U.S. South, from 2021 to 2022, the pine logging and hauling costs rose from $23.1 to $27.6 per metric ton, equivalent to a 19.6% increase (Forisk Consulting 2022). At the same time, the Arkansas Forestry Commission’s (2022) severance tax database reflected the greatest timber production decline in May of 2022 as compared to January. Excluding the disruption caused by the COVID-19 pandemic, historically, there is a slight seasonal decline of about 3.1% in May with respect to January, but 2022’s decline reached 14.5%. This raises the question if fuel prices influenced this change in production in the spring of 2022.

The major objectives of this paper are to assess the impact of increased fuel and maintenance costs on the logging industry of Arkansas in the spring of 2022. We also wanted to see if timber production would correlate with fuel price changes in such a short time. Therefore, we surveyed logging and/or hauling businesses in Arkansas to collect the data. This was also done to provide a rapid and valid assessment of the impacts of increased fuel, tires, lubricants, and spare parts prices on the logging industry in Arkansas to state policymakers.

METHODS

Study area

Arkansas’s economy is the third most dependent on forest products in the nation as a percentage of state GDP (Pelkki and Sherman 2020). In 2019, the logging sector alone generated 6,206 jobs and contributed $414.3 million to the state’s GDP. Logging is the crucial link between forests and wood products manufacturing, which in Arkansas supported 61,000 jobs and created a state GDP of 6.5 billion (Tian and Pelkki 2022). Recent fuel price changes have a direct impact on the logging operating costs (Baker 2022) and thus the profitability of the logging sector (He et al. 2021).

Data collection

To understand the impact of rapid fuel cost inflation on the logging sector, we conducted a survey of 430 logging and/or hauling firms from Arkansas in June and July 2022. The questionnaire contained 19 questions about the frequency and quantity of fuel purchased, the average fuel price paid per month, the monthly quantity of timber harvested and hauled, and the change in the price of spare parts and equipment. Because our objective was to explore the impact on the sector through the current fuel changes, other common logging costs, such as labor, equipment depreciation, insurance, repair and maintenance, interest expenses, and administrative costs (Baker et al. 2014) were excluded from the questionnaire. To assess the changes in the fuel costs and timber production quantities, we formulated the questions as a comparison between January and May 2022. January served as the baseline, given that fuel prices started to rise in February, as displayed in Figure 1.

Figure 1. Weekly Gulf Coast Fuel Prices (dollars per liter) (U.S. Energy Information Administration, 2022).

The questionnaire specifically asked:

What was the cost ($/gallon) of the fuel purchased in January and May of 2022?

Off-road Diesel On-road Diesel Gasoline

Jan 2022 May 2022 Jan 2022 May 2022 Jan 2022 May 2022

$/gallon $_______ $_______ $_______ $_______ $_______ $_______

Questions about logging and hauling volume were worded as “How many tons of wood were cut and loaded in January and May of 2022?” and “How many tons were hauled in January and May of 2022?”, respectively. The Imperial units were originally used in the questionnaire (e.g., tons, gallons, and miles) but converted into metric units (e.g., metric tons, liters, and kilometers) for the analysis.

The survey was distributed via e-mail and text message containing a Qualtrics (2022) link to the online survey. Survey participants had the option to request a paper version of the questionnaire, if preferred, which was sent by mail. The survey implementation followed a modified version of the Dillman Method (Dillman et al. 2014), consisting of a survey invitation, thank-you reminder, follow-up reminder, and final reminder e-mail or text message. After removing undelivered e-mail addresses, the effective sample size was 395 firms. In total, we obtained 135 responses, yielding a 34.2% response rate. However, due to a high rate of incomplete responses, only 41 (10.4%) observations were considered usable for the analysis. Given the difficulty in contacting logging firms, and the sensitive nature of the requested information, we considered this a good response rate. Following Allen et al. (2008), we assessed the presence of non-response bias by comparing the first 25% of the firms that responded to the survey to the last 25%, who served as a proxy of non-respondents. Differences between early and late respondents in terms of the number of tons harvested and hauled in January and May were analyzed using a t-test, which showed no statistically significant differences at a 0.05 alpha level. This supports the assumption that non-response bias in terms of responses to production levels was not a concern.

RESULTS

About 92% of the firms conducted both logging and hauling operations. Only 3% reported operating exclusively on logging and 5% on hauling. As reported in Table 1, the majority of logging and/or hauling firms purchased their fuel on a weekly basis. We did not observe a significant change in their fuel purchasing frequency between January and May 2022 for the three different fuel types: off-road diesel, on-road diesel, and gasoline. On-road diesel was the type of fuel the firms purchased the most (19,955.2-20,280.3 liters/month), followed by off-road diesel (15,008.0-15,050.0 liters/month), and lastly gasoline (2,696.7-2,561.2 liters/month). Compared to January 2022, in May, the firms purchased 0.3% more off-road diesel, 1.6% more on-road diesel, and 5% less gasoline. As expected, in May, all respondents reported a significant increase in the price of all fuel types by approximately 50%. This corresponds very closely to the data shown in Figure 1 and lends credibility to the supposition that loggers are aware of their business and operating costs.

Table 1. Arkansas loggers and haulers fuel purchasing frequency, quantity, and price by fuel type and month.

|

Off-road Diesel |

On-road Diesel |

Gasoline |

||||

|

Jan |

May |

Jan |

May |

Jan |

May |

|

|

Fuel purchasing frequency |

||||||

|

Daily |

19.5% |

17.5% |

20.0% |

20.5% |

20.0% |

20.0% |

|

Weekly |

56.1% |

57.5% |

65.0% |

59.0% |

72.5% |

72.5% |

|

Every two weeks |

9.8% |

5.0% |

2.5% |

5.1% |

2.5% |

2.5% |

|

Monthly |

14.6% |

20.0% |

12.5% |

15.4% |

5.0% |

5.0% |

|

N |

41 |

40 |

40 |

39 |

40 |

40 |

|

Fuel purchasing quantity |

||||||

|

Average liters/month |

15,008.0 |

15,050.0 |

19,955.2 |

20,280.3 |

2,696.7 |

2,561.2 |

|

N |

40 |

38 |

41 |

39 |

40 |

39 |

|

Fuel price |

||||||

|

Average dollars/liter |

0.79 |

1.22 |

0.90 |

1.35 |

0.79 |

1.16 |

|

N |

37 |

36 |

38 |

37 |

35 |

35 |

Logging firms cut on average 4,956.7 metric tons of wood in January and 4,637.3 in May 2022, representing an overall 6.4% decrease in the amount of wood harvested (Table 2). However, not all firms experienced a decline in their production. About a third reported harvesting more wood, and 18.4% maintained a constant production level. By contrast, 50.0% of loggers suffered a significant reduction in the number of tons harvested in May compared to January, corresponding to a 16.1% decrease. In terms of tons of wood transported to the mills, firms reported an overall 5.3% decrease from 4,474.6 metric tons in January to 4,239.3 in May 2022. The tons of wood hauled followed the same trend as the tons of wood harvested, with 33.3% of the sample hauling more and 19.4% hauling the same. Forty-seven percent of respondents suffered a significant decrease, representing 17.8% less timber hauled to the mills in May 2022.

Table 2. Arkansas loggers and haulers’ production level from January and May 2022.

|

N |

Percent |

Jan |

May |

p-value * |

|

|

Average metric tons of wood harvested |

38 |

100% |

4,956.7 |

4,637.3 |

0.277 |

|

Less |

19 |

50.0% |

5,206.1 |

4,365.7 |

<0.001 |

|

More |

12 |

31.6% |

4,645.2 |

5,402.9 |

0.078 |

|

No change |

7 |

18.4% |

4,769.2 |

4,769.2 |

- |

|

Average metric tons of wood hauled |

36 |

100% |

4,474.6 |

4,239.3 |

0.283 |

|

Less |

17 |

47.2% |

5,653.4 |

4,646.2 |

0.002 |

|

More |

12 |

33.3% |

2,670.6 |

3,391.3 |

0.073 |

|

No change |

7 |

19.4% |

4,704.4 |

4,704.4 |

- |

Note: *Significant difference based on a Paired t-test.

Part of the inflated fuel price burden was also absorbed by sawmills in the form of bonuses or additional compensation per ton paid to the logging firms. Results showed that 57.5% of respondents received additional compensation from sawmills. Of those who were compensated, 63.2% harvested less, 41.7% more, and 71.4% the same amount of wood. The mean compensation paid to the loggers was $1.4/metric ton averaged over all haul distances, accounting for 70% to 85% of the increase in fuel costs. A smaller percentage of logging firms (10.0%) were also able to pass on some of the cost increases by reducing the stumpage price paid for timber to the forest landowners. The distance travelled from the logging sites to the mills also impact the operating costs. The survey respondents indicated that the typical one-way distance from the logging site to the mill was 82.2 kilometers. Almost 50% of the firms agreed that access to interstate highways could decrease their hauling costs by reducing the driving distance and time by about 29 kilometers and 17 minutes per trip.

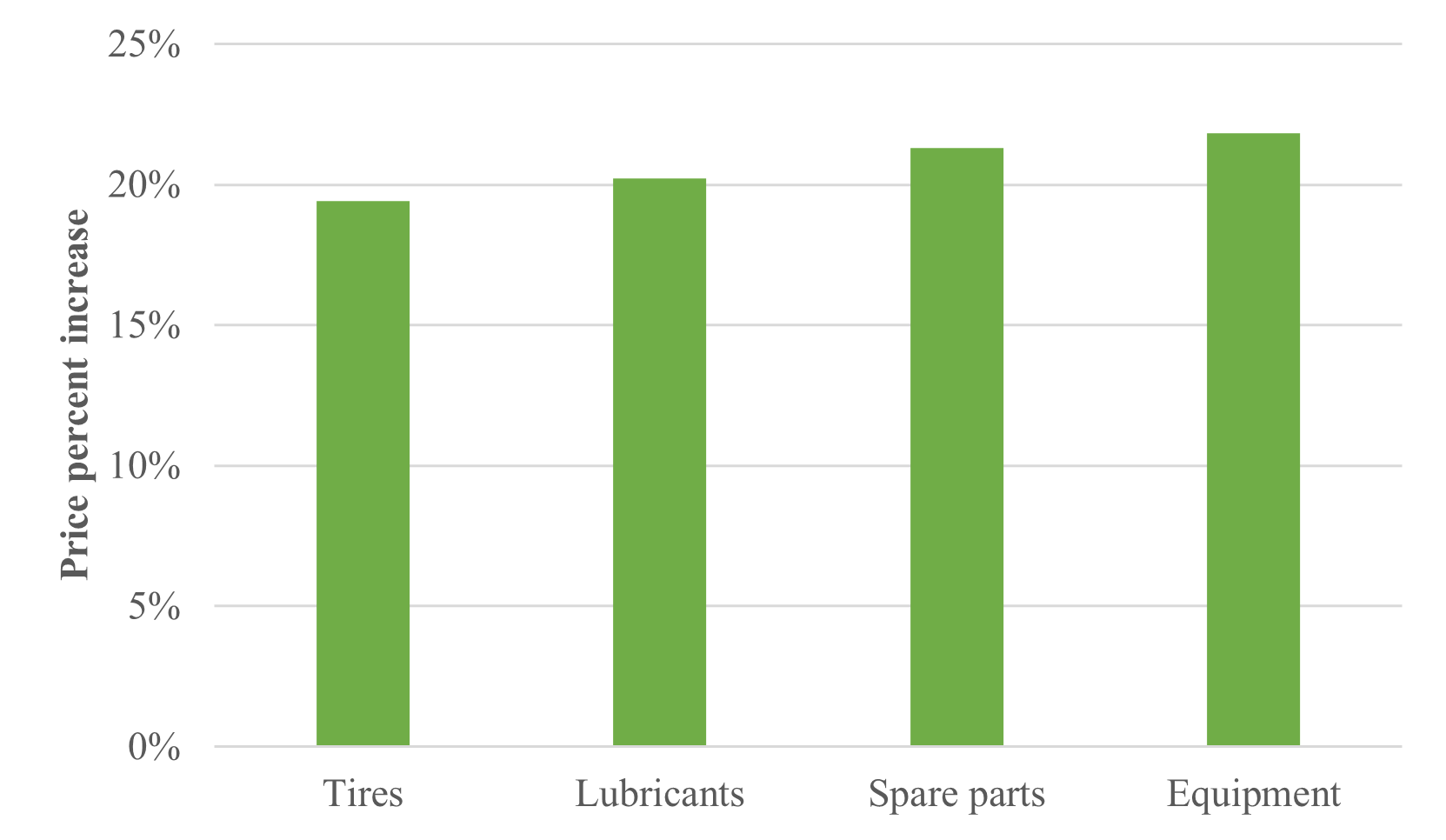

The increase in fuel prices is also reflected in the price of other goods demanded by the sector, such as tires, lubricants, spare parts, and logging equipment. More than 90% of the respondents expressed that the price of spare parts and equipment had increased in May as compared to January 2022; the remainder stated that the price did not change, and none of the firms indicated a decrease in the price. For those who experienced a price increase, they paid on average 19.4% more for tires, 20.2% more for lubricants, 21.3% more for spare parts, and 21.8% more for logging equipment (Figure 2).

Figure 2. Average percent increase in the price of spare parts and equipment from January to May 2022.

DISCUSSION

Over the last decade, with the aid of equipment upgrades and highly mechanized operations, the productivity of the logging sector increased by about 1.5% per year, allowing steady production costs in a context of low inflation (Baker 2022). Between 2021 and 2022, however, rapid inflation surpassed productivity gains. As fuel is a major component of logging’s total operational costs, the 2022 price increase posed great pressure on the sector that could not rapidly change its pricing structure and had relatively lower capital reserves than sawmills and papermills. Accordingly, the off-road and on-road diesel prices reported by the logging firms in this study were approximately 50% higher in May than those in January, which are also in line with the average south-wide prices recorded in the second quarter of 2022 (TimberMart-South, 2022b). Interestingly, despite fuel price increases, firms purchased slightly more off-road and on-road diesel in May. Similar anecdotal evidence was reported by the American Loggers Council (2022), which referred to this behavior as “panic buying or stockpiling.” It is common among loggers to buy and store “cheaper” fuel when fuel prices are predicted to continue to increase.

In terms of production, the overall trend was a decrease in the quantity of timber harvested, but different reactions among the logging firms were also observed; whereas some decreased supply, others increased it. Theoretically, when the cost of any factor of production increases, in this case, the fuel price, the logical response would be to decrease production (supply). However, only half of the loggers and timber haulers surveyed in this study behaved as expected, reducing production in May compared to January. A possible explanation behind this observation is that marginal revenue was reduced significantly because of the increasing fuel prices, and the loggers resorted to decrease production to lower the marginal cost. These firms might have understood that reducing production was in their best economic interest to achieve equilibrium and maximize profits

Besides rising operating costs due to fuel inflation, the logging sector was also challenged by a weakened housing market. The link between housing and the forest industry is obvious since one-third of all wood products is used to construct new residential units (McKeever and Elling 2015). However, the high interest rates prescribed to curb inflation caused house starts to fall by 4.2% in the second quarter of 2022 as compared to the first quarter (Archival Federal Reserve Economic Data 2022). Relatedly, lumber prices suffered a significant decline since their peak in March (Nasdaq 2022). A reduction in the demand and price of wood products could lead to sawmills procuring less wood and loggers decreasing production.

Other compounding factors, including weather conditions, could have also curtailed the loggers’ production. Historically in Arkansas, monthly logging production is lower between February and May (Arkansas Forestry Commission 2022), a period consistent with the heaviest rainfall season in the state (National Weather Service 2022) and the timeframe of this study. In the last five years, logging production in May dropped on average by 3.1% with respect to January, but in 2022, it fell from 1.69 million metric tons in January to 1.44 million in May (Arkansas Forestry Commission 2022). This corresponds to a 14.5% decline in the total timber harvested, almost five times greater than the usual seasonal decrease. April and May were particularly dryer in 2022 than the norm offering potentially better conditions for logging operations, but even so, the decline was much greater than in previous years. Although some of the production decline during this specific period could be attributed to the weather, fuel prices seemed to be a contributing factor as well.

The other 18.4% and 31.6% of loggers continued to harvest the same or higher quantities, respectively. Several reasons could have influenced them to increase supply in the short term. First, this reported inelastic response might be due to the logging businesses’ cost structure. The rising fuel prices might have pushed these firms’ average cost of production above the price charged per ton of wood (marginal revenue). In this scenario, the logging firms continued to produce to pay fixed costs, such as capital loans on equipment, while possibly incurring a loss. A similar trend was observed after the 2008 recession when, in the short term, logging firms would run without making profits if they could cover variable costs (He et al. 2021). While not supported by efficient economics practice, the concept of “working harder and longer” in difficult times is a quite human response to a cash flow problem. As stated above, capital costs are “fixed” in the short run, and logging firms are often family-operated businesses, and as such laying off employees is not a practical policy. Therefore, violations of the law of supply and demand are not uncommon in the logging industry.

Additionally, logging rates were also impacted by the changes in fuel prices possibly allowing some of these firms to continue producing the same or higher volumes. The first quarter of 2022 closed with average logging contract payments of $15.1 per metric ton and increased to $17 during the second quarter (TimberMart-South 2022a, 2022b). These rates were below the logging cost of $17.6 per metric ton reported by Baker (2022); however, 41.7% of the firms that increased production and 71.4% of the ones that kept production constant received additional payments per ton of wood brought to the sawmills. This compensation might have helped the loggers and haulers bridge the gap between costs and rates. Of note, this additional compensation was not immediate nor sustained after July 2022, when fuel prices began to fall but were still substantially higher than in January 2022. This trend is in line with the study of Baker et al. (2014), who reported that logging rates structured with a supplemental payment for diesel price increase after the 2008 recession.

Admittedly, it is possible that some firms could be fulfilling previous contracts or supply commitments with the sawmills preventing them from adjusting production in the short term. Although this could be true for some firms, anecdotal reports suggest that the vast majority of logging businesses in Arkansas operate as at-will loggers who maintain free agreements with the mills. Relatedly, Andersch et al. (2015) also found that sawmills in the southern states procure more wood from gatewood loggers than in any other states, meaning that logs are hauled to sawmills primarily by independent loggers and are not pre-ordered or ordered under a contract. Lastly, it is possible that there were fewer mill quotas given that 50% of the loggers decreased supply, allowing the other 31.6% of loggers to increase their production to fill the gap in the mills’ demand. Often, for these firms, the amount of wood harvested would depend on what the mills are willing to take in.

To offset the rising fuel costs, some loggers opt to minimize haul distances (Moldenhauer and Bolding 2009). In the south, the average haul distance fell from 98.2 kilometers in the first quarter to 77.2 kilometers in the second quarter of 2022 (TimberMart-South 2022a, 2022b). Consistent with the southern average of the second quarter, the firms in this study indicated that the typical average haul distance was 82.2 kilometers. Relatedly, to decrease the hauling costs, about half of the surveyed firms reported that allowing them to access the interstate highways would reduce driving distance and time.

In the long term, logging firms might resort to different mechanisms to compensate for higher variable costs, including deferring maintenance, furloughing employees, using the company and/or personal savings, or borrowing money (Pelkki 2012). For example, some participants of this survey expressed in the comments section that they had to take bank loans to cover their maintenance expenses; others were considering shutting down the logging business.

The literature suggests that the major challenges faced by the logging sector in the U.S. in the last 20 to 30 years are structural shortages of logging labor and rising operating costs (He et al. 2021). At the same time, the effects of high fuel prices also have important ramifications in the workforce of logging contractors; for example, Moldenhauer and Bolding (2009) reported that the high fuel price led to a diminishing workforce. We excluded labor-related questions from the survey, but future research can focus on the impact of fuel prices on employment, specifically in Arkansas, where the direct economic contribution of this sector in terms of employment is significant.

Our study has some limitations. First, the period analyzed in this study is short, comprising only the first five months of the year. This impedes the long-term analysis of the effects of fuel price fluctuations on the logging and hauling sector. The effects of increased fuel prices in the first half of 2022 may be observed much later as logging firms leave the business once they can escape fixed costs such as contracts, loans, and capital expenses (e.g., selling their logging equipment). Second, since our survey focused on rising fuel costs and the loggers’ response in terms of production quantities, we did not gather specific financial information to characterize the firms’ profitability, such as revenues and other operating costs like insurance premiums, wages, and logging equipment. Nor did we ask about capital reserves that would help a logging firm survive short-term cost increases. We acknowledge that our data represents an incomplete picture, which does not permit fully characterizing the firms’ financial performance in the current economic context.

CONCLUSION

This paper explored the performance of the logging sector in Arkansas in the first five months of 2022 after the dramatic increase in fuel prices. This assessment found that the logging sector saw a decline in overall timber production. We expected that the increase in production costs would cause the majority of firms to decline the quantity of wood supplied; instead, some firms also exhibited an increase in supply. Fuel price inflation alone seemed not to be the only driving factor in the firms’ production response, but rather other contributing factors could have also played a role.

ACKNOWLEDGMENTS

This research was funded by the Arkansas Center for Forest Business at the University of Arkansas at Monticello. We are thankful to the respondents for their time and effort in completing the survey and for the support provided by the College of Forestry, Agriculture & Natural Resources and the Arkansas Center for Forest Business at the University of Arkansas at Monticello in completing this study.

CONFLICT OF INTERESTS

The authors declare no conflict of interest.

REFERENCES CITED

Archival Federal Reserve Economic Data. 2022. New privately-owned housing units started: total units. Accessed 5 December 2022. Available from: https://alfred.stlouisfed.org/series?seid=HOUST

Allen TT, Han HS, Shook SR. 2008. A structural assessment of the contract logging sector in the Inland Northwest. For. Prod. J. 58(5), p.27.

Andersch A, Montague I, Buehlmann U, Wiedenbeck JK. 2015. U.S. Hardwood sawmill log procurement practices. BioResources. (10)1: 1224-1244.

American Loggers Council. Surging fuel prices! Who is hurting? Why is it hurting? Where is it going? 2022. Accessed 25 August 2022. Available from: https://www.amloggers.com/news/surging-fuel-prices-who-is-it-hurting-why-is-it-hurting-where-is-it-going

Arkansas Forestry Commission. 2022. Severance Tax Database. Arkansas Forestry Commission State Office, Little Rock, AR.

Baker SA. 2022. Forest operations: wood supply chain costs and constraints [conference presentation]. In: Wood Flows and Cash Flows Conference. Forisk Consulting, August 25, 2022, Athens, Georgia.

Baker SA, Greene WD. 2008. Changes in Georgia’s logging workforce, 1987–2007. South. J. Appl. For. 32(2):60–68.

Baker SA, Mei B, Harris TG, Greene WD. 2014. An index for logging cost changes across the U.S. South. J. For. 112(3): 296-301.

Cubbage FW, Carter D. 1994. Productivity and cost changes in southern pulpwood harvesting, 1979 to 1987. South. J. Appl. For. 18(2):83–90.

Conrad JL IV. 2014. Adapting to a changing landscape: how Wisconsin loggers persist in an era of parcelization. For. Prod. J. 64(7/8):273–280.

Dillman DA, Smyth JD, Christian LM. 2014. Internet, phone, mail, and mixed-mode surveys: The tailored design method. John Wiley & Sons.

Egan AF. 2005. Training preferences and attitudes among loggers in northern New England. For. Prod. J. 55(3):19–26.

Egan AF, Hassler CC, Grushecky ST. 1997. Logger certification and training: a view from West Virginia’s logging community. For. Prod. J. 47(7–8):46–50.

Forisk Consulting. 2022. Forisk Research Quarterly 2022 Q4.

Greene WD, Biang E, Baker SA. 2014. Fuel consumption rates of southern timber harvesting equipment. In: Proceedings of the 37th Council on Forest Engineering. June 22-25, 2014, Moline, Illinois.

Greene WD, Jackson BD, Culpepper JD. 2001. Georgia’s logging businesses, 1987–1997. For. Prod. J. 51(1):25-28.

Greene WD, Cubbage FW, McNeel JF. 1988. Characteristics of independent loggers in Georgia. For. Prod. J. 38(7/8):51–56.

Greene WD, Marchman SC, Baker SC. 2013. Changes in logging firm demographics and logging capacity in the U.S. South. In Proceedings of the 36th Annual Council on Forest Engineering Meeting, Dodson, E. (ed.). Missoula, MT. 7 p.

He M, Smidt M, Li W, Zhang Y. 2021. Logging industry in the United States: employment and profitability. Forests, 12(12), p.1720.

Kelly MC, Germain RH, Bick S. 2017. Impacts of forestry best management practices on logging costs and productivity in the Northeastern USA. J. For. 115:503–512.

LeBel L. 1993. Production capacity in the southern logging industry. MS thesis, Virginia Tech, Blacksburg, VA. 127 p.

Leon BH, Benjamin JG. 2013. A survey of business attributes, harvest capacity and equipment infrastructure of logging businesses in the Northern Forest. Univ. of Maine, Orono, ME. 29 p.

Loving E. 1991. Components of logging costs. MS thesis, Virginia Tech, Blacksburg, VA. 205 p.

McKeever DB, Elling J. 2015. Wood products other building materials used in new residential construction in the United States. Tacoma, WA: APA - The Engineered Wood Assoc. 2015; 131 p.

Mei B, Clutter ML, Harris TG. 2013. Timberland return drivers and timberland returns and risks: A simulation approach. South J. Appl. For. 37(1):18–25.

Miyata ES. 1980. Determining fixed and operating costs of logging equipment. General Technical Report NC-55. St. Paul, MN: U.S. Dept. of Agriculture, Forest Service, North Central Forest Experiment Station.

Miyata ES, Steinhilb HM, Winsauer SA 1981. Application of work sampling technique to analyze logging operations. Research Paper NC-213. St. Paul, MN: U.S. Dept. of Agriculture, Forest Service, North Central Forest Experiment Station

Moldenhauer MC, Bolding MC. 2009. Parcelization of South Carolina’s private forestland: Loggers’ reactions to a growing threat. For. Prod. J. 59(6):37–43.

Montgomery RA, Pelkki MH, Mehmood SR. 2005. Use and cost of best management practices (BMPs) and related Sustainable Forestry Initiative guidelines to Arkansas timber producers. For. Prod. J. 55(9):67–73.

Nasdaq. 2022. Lumber (LBS). Accessed 5 December 2022. Available from: https://www.nasdaq.com/market-activity/commodities/lbs

National Weather Service. 2022. Monthly total precipitation for Little Rock area, AR. Accessed 15 November 2022. Available from: https://www.weather.gov/wrh/climate?wfo=lzk

Pelkki MH. 2012. The financial health and response of Arkansas’s loggers to depressed timber markets and severe operating conditions of 2009. South. J. Appl. For. 36(2), pp.92-97.

Pelkki MH, Sherman G. 2020. Forestry’s economic contribution in the United States, 2016. For. Prod. J. 70(1), pp.28-38.

Qualtrics. 2022. Accessed from: https://www.qualtrics.com

Smidt MF, Blinn CR. 1994. Evaluation of continuing education needs in Minnesota. For. Prod. J. 44(3):57–62.

Stuart WB, Grace LA. 1999. Wood supplier productivity and cost survey. American Pulpwood Association, Tech. Pap., Washington, DC. 46 p.

Tian N, Pelkki MH. 2022. Report on economic contributions of Arkansas forest industries. Accessed 25 August 2022. Available from: https://www.uamont.edu/academics/CFANR/pdfs/reports/EconomicContributions2022Report.pdf

TimberMart-South. 2022a. Biomass, Logging Rates, & Species Detail: 1st Quarter 2022.

TimberMart-South. 2022b. Biomass, Logging Rates, & Species Detail: 2nd Quarter 2022.

US Energy Information Administration. 2022. Gasoline and Diesel Fuel Update. Accessed 25 August 2022. https://www.eia.gov/petroleum/gasdiesel/